County funds ‘will be shared equitably’

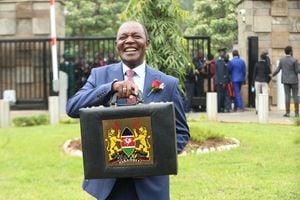

Photo/FILE

Chairman of the Commission on Revenue Allocation (CRA) Micah Cheserem after taking the oath of office at the High Court January 11, 2011.

What you need to know:

- This week, Mr MICAH CHESEREM, the chairman of the Commission on Revenue Allocation, fields questions from readers.

How fair is the revenue sharing formula that you have proposed?

The proposed revenue sharing formula is fair in that it is in line with the equitable share principles set out in the Constitution.

The following five parameters, with their weights, that we have selected are anchored in the Constitution:

- Population – 60 percent: this ensures equal allocation to every Kenyan.

- Equal share – 20 percent: This recognises the fact that all county governments, irrespective of their size, have fixed basic expenses such as running the county executive and county assembly.

- Levels of poverty – 12 percent: This allocates equal amount of money to the county for every person classified as poor in that county.

- Land area – six percent: Service delivery is more costly in those counties that have expanse land areas.

- Fiscal discipline – two percent: This will promote financial discipline and encourage counties to focus more on raising their own revenues.

Based on this year’s budget, what is the average take home for each country?

The average allocation to each county government is estimated at Sh3 billion. We are, however, awaiting the release of the final national census figures by the Kenya National Bureau of Statistics before we release the recommendations for monies to each county.

It should be appreciated that some counties will get less and others more than Sh3 billion depending on the computations from the equitable formula.

The North Kenya counties had disputed census results. What strategies are you putting in place to ensure there is fairness now that population forms the biggest basis of the money received by a country?

The Commission on Reveneu Allocation is aware that issues have been raised with regard to the census data.

We trust that the final census that will be released soon by Kenya National Bureau of Statistics will be acceptable to all county governments.

As you know, CRA is required to use the official data as released by the Kenya National Bureau of Statistics.

What is the fate of the current devolved funds such as the Constituency Development Fund (CDF) and the Local Authorities Transfer Funds (LATF)?

Devolved funds such as CDF and LATF will in future be merged with the 15 percent allocation so that all monies will be channelled through the offices of the Governors.

Members of Parliament under the new Constitution will be tasked with making legislation in Nairobi. The responsibility of spending money in the counties will be left to the County Government Executive, led by the Governor.

What are the financial powers of the governor and county assembly? Does the latter approve use of funds as the National Assembly does after budget reading?

The Governor’s role is to prepare the budget and submit it for discussion and approval by the County Assembly. The County Assembly will be monitoring the expenditures by the County Executive on a regular basis.

The Sh3 billion to be given to the counties is clearly not enough as the county facts sheet you recently published show that only 40 per cent of the counties can deliver services without national government support. How will the counties raise additional finances to ensure they stay afloat?

The exact amount to be paid out to each county is yet to be determined. The bulk of the funds that will be allocated is to pay for services that will be devolved as listed on Schedule Four of the Constitution.

We will recommend allocation of adequate funds to cover the expenses of all functions that will be devolved to each county government.

We will also be encouraging each county government to make every effort to raise additional revenues by improving their efficiency in collecting the taxes that they are permitted to impose by the Constitution.

There are fears that county governments might have to raise the amount of levies they charge to cater for the great expectations residents have on them. What measures have you put in place to ensure this will not be the case?

The Constitution lists the taxes that county governments may impose. These include: property taxes, entertainment taxes and any other tax that is authorised to be imposed by an Act of Parliament. They are also permitted to impose charges for services.

The Constitution goes further to state that the taxation and other revenue-raising powers of a county shall not be exercised in a way that prejudices national economic policies, economic activities across county boundaries or national mobility of goods, services, capital or labour.

It should be borne in mind that every county government will be making every effort to attract local and foreign investors to their county. They will therefore be very careful not to be seen to imposing higher taxes than other counties.

One of the contentious issues in the Finance Management Bill was the definition of what the 15 per cent of the revenue to be shared mean, with the Treasury insisting it is only the Kenya Revenue Authority collects and does not include grants. Which definition have you adopted?

The revenue that has been raised nationally that shall be shared will include taxes collected by the Kenya Revenue Authority as well as all other revenues such as stamp duty, land rent, dividends and interest received.

The major revenues that will not be shareable are loan proceeds such as receipts from Treasury Bills and Bonds including loans from foreign governments.

There are no differences that we are aware of between our Commission and the Treasury regarding the revenue that will be shareable.

Who will foot the bill for the construction of county headquarters? Is it the county government or the national exchequer?

It is generally agreed that there are enough buildings in the proposed county headquarters and therefore, there will be no requirement to allocate money for construction.

The Transitional Authority which will be formed in the next few months, will work closely with the Ministry of Public Works to identify the current offices of Local Government and Provincial Administration that will be renovated to house the County Executive and County Assembly.

In the exceptional cases that additional buildings will be necessary, then the National Government will meet the bill for such construction.

There have been conflicts in the past with local residents laying claim to national resources located in their areas. How will revenues from such resources be shared out?

Revenue arising from the national resources such as coal and oil, if and when discovered, is first collected by the national government and be shared out through the equitable formula.

The draft Mineral Bill has rightly made a proposal that a certain percentage of the revenue from such national resources shall be paid to county in which the resource is located.