No tax surprises, but plenty of goodies for the masses

MPs follow Budget proceedings in Parliament on June 14, 2012. Photo/JENNIFER MUIRURI

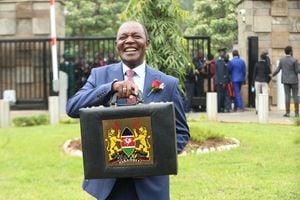

Finance minister Njeru Githae on Thursday delivered a politically-savvy budget, promising a lot of goodies but withheld the pain of a slowing economy in an election year.

There were no tax surprises, but many welfare measures in a Sh1.45 trillion budget.

Mr Githae set aside more money for hiring 10,000 extra teachers, 5,200 health workers and an extra 3,500 police officers.

The minister cut taxes on second hand clothes, zero rated duty on digital TV set top boxes and removed tax on food supplements in an attempt to check the rising cost of living.

But landlords and tenants face tough times after the minister introduced new measures to rope them into the tax bracket to shore up revenues.

KRA estimates it can collect about Sh90 billion in rental income tax annually.

KRA had in 2005 announced plans to use bank accounts to start taxing landlords but the move fell apart after banks refused to cooperate.

To appease low income earners, the government reverted to the old tax on second-hand clothes.

Traders will now pay Sh1.1 million down from Sh1.9 million per 20ft container.

The increased tax has been an issue of contention between the traders and the Kenya Revenue Authority (KRA) forcing a cutback on second hand clothes imports.

But civil servants ranked among the biggest losers after the proposed Sh15.1 billion pension scheme was deferred to July 2013.

The delay means retiring civil servants will not benefit from the scheme, while those nearing the retirement age will get less in final dues.

To cushion local iron and steel manufacturers from cheaper imports, Mr Githae imposed a 10 per cent import duty on galvanized wire.

In a bid to respond to increasing insecurity, Mr Githae increased the allocation for national security from Sh78 billion to Sh83.5 billion.

And to cement, Kibaki’s free primary education legacy, Treasury allocated Sh233 billion to the Ministry of Education.

Of this, Sh118.7 billion will be used to hire 10,000 teachers more teachers and build new schools.

He also set aside Sh1.6 billion for employment of pre-primary school teachers.

Mr Githae allocated Sh1.1 billion for bursaries for children from poor families.

“I have also allocated Sh300 million toward provision of sanitary towels for girls from poor families in primary schools,” he said.

The health sector received a 16.9 per cent boost, with its allocation rising from Sh73 billion last year to 85 billion.

The money will be used to employ 5,200 health workers, including 900 doctors, and implement the second phase of allowances medical staff.

The war on drug abuse was given a Sh1 billion boost for among other things, fund Nacada enforce the controversial Alcohol Act.

Patients and deceased persons detained in public hospitals for nonpayment of requisite charges should also expect some relief.

“As a government that cares for its people, the Treasury, working with the ministry responsible for health care, will shortly engage with key public hospitals with records of such experiences to develop appropriate guidelines on how to cushion the very poor families by defraying such costs,” Mr Githae said.

He further set aside Sh4.4 billion for orphans and vulnerable children, Sh1 billion for the elderly persons and Sh2.1 billion for the school feeding programme in arid and semiarid areas.

The minister allocated Sh1.5 billion to clear coffee, rice and sugar farmers’ debts.

The Treasury also set aside Sh550 million for the Youth Enterprise Development Fund and Sh440 million for the Women Enterprise Fund.