We’ll not pay a penny, swear MPs in tax row

KRA Commissioner General John Njiraini. In September 2013, KRA Commissioner General said the authority had recovered Sh4 billion since 2007 in unpaid taxes following an audit of 40 multinationals. PHOTO | FILE | NATION MEDIA GROUP

Members of Parliament were on Thursday adamant that they would not obey demands by Kenya Revenue Authority to pay tax on their full Sh850,000 salary.

Furious MPs described KRA officials as “uncivilised” and quoted sections of the law they claimed supported their right not to pay taxes like other Kenyans.

They dismissed the Commission on the Implementation of the Constitution as having “no role in interpreting the constitution”.

MPs refusal comes even as the Judiciary, which is also affected by the new law, has agreed to comply, and has asked Treasury to help its members, including judges and the Chief Justice to obey the Constitution.

The CIC had said that MPs must pay their bit. Many institutions, including political parties to which the MPs belong, have been referring matters of constitutional interpretation to the CIC.

The Constitution is unambiguous: all state officers, including MPs and holders of constitutional office, must pay taxes. The Constitution actually bars Parliament from making a law that exempts anyone from paying tax.

Speaker Kenneth Marende, admonishing Finance Minister Uhuru Kenyatta for not following the Constitution, recently ruled that unless expressly suspended in the transitional clauses, a section of the Constitution is assumed to be in force and must be obeyed.

It now remains to be seen whether Parliament will change its understanding of the Constitution to accommodate the MPs’ demands.

MPs have been arguing that the status quo should be maintained until after the next election on the basis of a legal opinion by the Attorney-General last July that they will not be taxed until the end of their term.

KRA has dismissed the AG’s opinion as the views of one State department, and has threatened to auction MPs’ property and raid their accounts if they don’t pay their taxes with arrears.

It is highly unlikely, in the event of a lawsuit that judges will agree to be taxed but make an exception of MPs.

Yesterday, the Parliamentary Service Commission (PSC) — the administrative wing of the House — defended MPs, saying they will not pay tax until the law is reviewed.

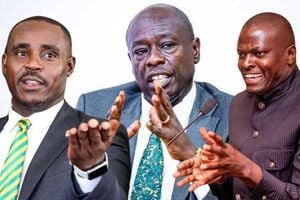

Mr Walter Nyambati, the vice-chairman of the PSC and MPs Olago Aluoch and Jamleck Kamau, both members of the commission, also accused the taxman of malice and mischief, for publicly demanding that they pay up.

Mischievous

“(The commissioner of domestic taxes, Mr John) Njiraini, is being mischievous and malicious. This is one arm of government. KRA has not instituted any discussion with the Parliamentary Service Commission. They’re inciting the public against their Parliament. It is wrong. Totally wrong,” Mr Nyambati said.

They said PSC had initiated talks with the KRA, the Treasury and Attorney General Amos Wako, with a view to having the directive rescinded.

And separately, Kinangop MP David Ngugi accused the Government of sparking the storm over MPs taxation as a “diversionary tactic.”

“Faced with the uphill task of dealing with the runaway cost of living and theft of public funds in the high offices, the government is attempting to divert attention from these crucial issues by appearing to demonise MPs who have not violated the Constitution in as far as taxation is concerned,” Mr Ngugi said.

Mr Aluoch said of Mr Njiraini: “He is mischievous and uncivilised. You don’t start by demanding and threatening at the same time. The way forward is for Parliament to engage the Treasury and tell him to take responsibility and say he was wrong for issuing the threats about auctioning our assets.”

“The bottom line is, we’ve to be civilised. Our dealings must be civilised. There’s no reason why KRA must give threats to MPs. If he wrote to us, we’ve not written back. He should wait for us to communicate to him, if our communication is negative, that’s when he could have gone public,” Mr Nyambati added.

About the threats

“We have to sit down with the KRA, and agree. If there’s any issue about paying tax, at the end of the negotiations, we’ll pay. We’re angry about the threats being issued by the KRA.”

The three dismissed as “nonsense and rubbish” the excuse of MPs that they have commitments and that’s why they should not pay tax.

Mr Aluoch told off his colleagues who have threatened to repeal the KRA Act or block this year’s budget if the taxman goes ahead and takes his share from their perks.

“These are MPs with kneejerk reaction. I repeat this is nonsense. It should not be mentioned. We should be going by the law, and so far the law is on the on the side of MPs. It would be reckless,” Mr Aluoch said.

The PSC commissioners fell back on what it termed as the “opinion of the Attorney General” issued last July, just before the referendum on the Constitution, saying that the KRA can’t tax them both “in law and in fact”.

Mr Kamau said the President and the AG, “unless they were not being genuine”, promised to abide by the opinion and protect MP’s tax free allowances until their term in Parliament ends.

While, they noted that the AG’s opinion cannot be superior to the Constitution, they said it was based on law and that anyone with a problem should go to the Supreme Court for interpretation.

They then cited Section 6 of the Sixth Schedule, which says the rights and obligations that were enjoyed under the old Constitution shall be enjoyed in the transition period.

They argued that their obligation was to pay tax, while the government’s was to collect tax. However, they said, it was a right under the “laws of natural justice and principle of reasonable expectation” for them to enjoy their tax-free perks totalling Sh651,000. They just pay tax on their Sh200,000 basic salary.

“You cannot change the terms of an employee’s contract midway, before the term ends. Full stop! People are arguing based on emotion rather than fact and truth,” Mr Aluoch said. The MP for Kisumu Town West quoted the Income Tax Act, saying, there was a provision to cater for such situations because there is a discrepancy in the law. Under this law, the Finance Minister can also direct the commissioner to collect tax from MPs.

They said that once the Speaker comes back from his international trip, the AG’s opinion and the letter from the KRA will be made public and that the status quo will remain.

“Under the legal principle of Estoppel, he cannot go back to say that he’s changed his mind,” Mr Aluoch said of the AG.

He said the Commission for the Implementation of the Constitution had no role in interpreting the law.

The tax exemption on MPs’ perks was first introduced in law in 1975. The current pay was set in 2003 after a report by a tribunal by former judge Majid Cockar.