The fight to save CBK governor in high gear

PHOTO | FILE

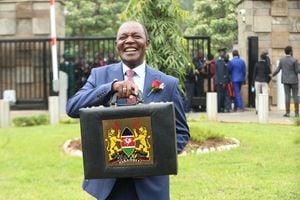

CBK Governor Prof. Njuguna Ndung'u. Prof. Ndung’u, said the decision to lower the CBR had been informed by the steady decline in inflation levels in recent months, relative stability of the shilling and strong business confidence.

What you need to know:

- Report on shilling’s slide has been met with opposition

Backroom deals, intensive lobbying and outright intimidation preceded the initiation of debate on the report of the House committee which investigated the rapid decline of the shilling.

Commercial banks and bankers are said to have carried out a campaign to discredit the report alongside sending their emissaries to Parliament to ask MPs to reject the report. (READ: Shilling debate put off as MPs clash)

There are also reports that some bankers called on Mr Adan Keynan, the chairman of the committee that investigated the rapid decline of the shilling, and asked him to delay debate on the report.

The stakes are high in the debate of the report of the committee. If the report is adopted without amendments, President Kibaki will have to appoint a tribunal to decide on the competence of Central Bank Governor Njuguna Ndung’u.

The basis

The report will also form the basis upon which the ministry of Finance and the Treasury will face sanctions in the House if the people at the helm do not force banks to lower interest rates to levels that prevailed before the slide of the shilling.

But that is a bullet those in charge of the Kenyan economy are unwilling to bite because they made an unequivocal promise to the International Monetary Fund that they will not, in the foreseeable future, shift from the high interest rate system.

The signals that Mr Keynan and his team were in for tough times in the House came as soon as he got on his feet to inform the House of the contents of the report.

Githunguri MP Njoroge Baiya rose, seeking to halt the debate on a technicality — that the committee, in its recommendations, “purported to issue directives” on how the Central Bank has to conduct its affairs.

But before Mr Baiya could expound on the details of why he thought the committee had breached the law, he was told that he ought to wait until Mr Keynan finished introduction of debate and it is seconded before interrupting.

Mr Keynan continued but was soon interrupted by assistant minister Ndiritu Muriithi. The bane was that the recommendations of the committee were illegal, and if adopted, would impinge on the autonomy enjoyed by the Central Bank.

“The Constitution of this great Republic, in Article 231, establishes the Central Bank of Kenya and proceeds to say that the Central Bank of Kenya shall not be under the direction of any person or any entity,” said Mr Muriithi, who is also President Kibaki’s nephew.

But that, too, was premature according to the procedure of the House.

The President is said to have a soft spot for Prof Ndung’u and is unlikely to yield to the House resolutions given the contest about the real cause of the depreciating shilling. (READ: CBK on the spot over shilling decline)

While some MPs maintain it was a deliberate case of “economic crimes”, top officials in government hold the view that it was a result of Kenya having more imports than exports, high fuel prices, economic turmoil in the Euro Zone, debt crisis in the US, and supply side shocks arising from the food shortage in the country.

Given that the President has ignored two indictments of Cabinet ministers by the House, it is not surprising that the mandarins are banking on him to once again ignore a resolution to eject the governor — he who has supported economic growth with a consistent regime of low interest — from the CBK.

There has emerged a pattern in the House whenever controversial matters are up for debate. The person initiating debate is interrupted and basically blocked from making a coherent persuasion to the House on why it ought to take a particular resolution.

While MPs support the recommendation that interest rates should be lowered “to affordable rates within three months of the adoption of the report by the House”, they are said to be keen to delete sections of the report that make reference to Central Bank and the Central Bank governor.

Proposed amendment

The lawmakers are also said to be out to block the proposed amendment to the law to increase the penalty for banks engaging in malpractice from the “lenient” Sh1 million to a “more deterrent penalty of 50 per cent of the amount involved or Sh20 million whichever is greater”.

MPs, mainly from Murang’a, the birthplace of the governor, among them Jamleck Kamau (Kigumo) and Maina Kamau (Kandara) were agitated as Mr Keynan sought to persuade the House to adopt the report, lending credence to the whispers in Parliament that the fight to save the governor has regional undertones with shades of cronyism.

The amendments that MPs in Prof Ndung’us corner want made to the report include deletion of the declaration that his “conduct and behaviour was incompatible with the holder of the office of Governor of the Central Bank of Kenya”.

They also want the recommendation that take responsibility and step aside for mismanagement of the crisis removed.