Moi-era businessman Kangwana opens microfinance bank

What you need to know:

- Maisha Microfinance Bank will roll out micro insurance products besides providing low-cost banking products.

- The bank will advance micro loans as low as Sh10,000 and up to Sh350,000 with a turnaround processing time of two days.

A former influential Moi-era businessman Jared Kangwana has teamed up with his business associates to open a new microfinance bank targeting small traders.

Mr Kangwana is associated with the Monarch Group that owns Monarch Insurance and a raft of real estate properties including Chester House in Nairobi’s Central Business District-- where Maisha Microfinance Bank’s first branch will be located.

The bank’s six directors include University don Beatrice Shabana, managing partner at Grant Thornton Kenya Kamal Shah and visiting professor at Strathmore Business School Prof Alejandro Lago.

Maisha MFB becomes the 13th micro lender licensed by the Central Bank of Kenya (CBK).

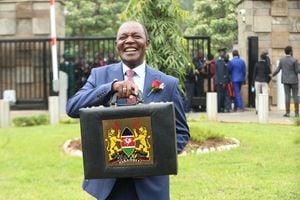

Speaking at the bank’s launch ceremony in Nairobi on Thursday, CEO Ireneus Gichana said the micro-lender would seek to bridge the existing financial inclusion gap in the country.

“In 2014 25.4 per cent of Kenyans were excluded from financial access, this has since reduced to 17.4 per cent to date. But people are still stashing their money in secret places including mattresses and so there is a huge gap to fill,” said Mr Gichana.

He said the bank will roll out micro insurance products besides providing low-cost banking products.

The lender will advance micro loans as low as Sh10,000 and up to Sh350,000 with a turnaround processing time of two days.

Maisha’s initial capitalisation is Sh90 million. The CBK requires microfinance banks to have a core capital of Sh60 million.

To gain an edge over its peers, Maisha has poached senior management staff from industry giants including Equity Bank and Family Bank to boost its operations.

The talent includes the CEO who is a seasoned banker with a working experience in both microfinance and conventional banking spanning 24 years.

Mr Gichana previously worked at Faulu Microfinance Bank as head of operations between 2010 and September 2015. He also worked with Standard Chartered Bank of Kenya holding various positions.

Others are the bank’s credit and operations manager Nicholas Mutua who formerly worked for Equity and Rakifi Microfinance Bank.

Maisha’s finance and administration manager Robert Kariuki was formerly the finance manager at Sumac Microfinance Bank having earlier worked for Equity in various positions while the bank’s audit and risk manager Isaac Ogutu joined from Faulu Microfinance Bank where he worked as an internal auditor.

Its business development manager Michael Muriithi has worked at Family and also served as a branch manager at Jamii Bora Bank.

Maisha MFB currently has 13 employees and 500 customers have to date opened accounts.

Speaking during the bank’s opening, CBK board chairman Mohammed Nyaoga said the regulator is keen to foster financial inclusion in the industry by encouraging the growth of microfinance.