Safaricom profit down 23 p.c.

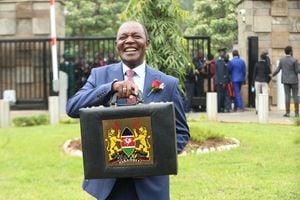

Finance minister Uhuru Kenyatta and Safaricom’s chief executive Michael Joseph, during the release of the company’s results at a Nairobi hotel. Photo/FREDRICK ONYANGO

Kenya mobile phone service provider, Safaricom, registered a 23 per cent fall in profitability, showing vulnerability to low tariff pricing and high cost of goods.

And for shareholders, a Sh4 billion dividend payout failed to translate to good news, as the large number of shares (40 billion) mean they will each get 10 cents per share. That means that shareholders who were allocated the minimum 420 shares will receive Sh42 only.

In the year ending March 31, 2009, Safaricom’s pre-tax profit shrank Sh5 billion to settle at Sh15 billion down from about Sh20 billion recorded in 2008.

The profit decline was however not too heavy to dislodge Safaricom’s regional ranking as the most profitable (listed) company in the East Africa.

“These results were delivered despite the difficult economic conditions encountered during the year,” Safaricom’s chief executive, Michael Joseph said Thursday, during announcement of the firm’s financial results.

While the company managed to drive up its revenue by 15 per cent, management says irrational tariff pricing by its competition — which saw some operators cut their tariffs to one shilling per minute — negatively impacted on its bottom line.

Competition

To keep up with its competition, Safaricom readjusted its pricing by about 70 per cent to Sh3 per minute under the Jibambie promotion.

Before reviewing its tariffs, Safaricom was charging Sh10 per minute for within network calls and Sh15 per minute for across network calls.

“Irrational pricing made it very challenging for us, but not as much as it did to our competition. Overall, however, the biggest impact on our profitability came from inflation which impacted heavily on our core customers,” Mr Joseph noted.

With over 13.4 million subscribers, Safaricom’s customers are mainly in the lower end of the consumption bracket, highly vulnerable to change in prices.

Largely driven by effects of the post-election violence and drought, food prices remained high over 2008 to average above 30 per cent.

Overall inflation has also remained high, oscillating between 25 per cent and 31.1 per cent, meaning that each month Kenyan consumers’ purchasing power reduces by at least a quarter, pushing the poor to survival mode where food becomes a priority.

High oil prices and volatile foreign exchange have also played a part in cutting on the growth pace, as they added to operational costs which went up by about 22 per cent.

Going forward, the company could get reprieve as tariff pricing is set to normalise with some of its competition calling off the price war. Last week, Zain announced a tariff price increase saying the time for price wars was over.

Safaricom has also registered marked growth in alternative revenue sources as it seeks to reduce its reliance in call revenue (currently at 83 per cent of total revenue) with data business registering 83 per cent growth to account for 13 per cent of total revenue.

M-Pesa has also registered notable growth with over 6 million subscribers against 2 million users last year.