Billions in tax revenue goes missing

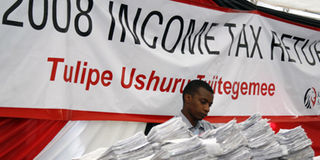

A clerk at the KRA headquarters receives tax return forms from members of public outside the Kenya Revenue Authority offices. The Government could have lost billions of shillings over the years as exact figures of the amounts collected in tax revenue remain unknown. Photo/FILE

What you need to know:

- Mars Group presents figures showing about Sh98.4bn in fiscal year 2007/08 was unaccounted for

The Government could have lost billions of shillings over the years as exact figures of the amounts collected in tax revenue remain unknown.

Figures presented by the Mars Group, a watchdog organisation, to the budget committee yesterday indicated that in the 2007/08 financial year, some Sh98.4 billion in ordinary revenue was not accounted for.

“What is shocking is that in June 2009, a month after receiving the auditor-general’s certified accounts indicating receipt of Sh496 billion, the Finance Minister declared Sh397 billion to Parliament — a difference of Sh98 billion,” said Mars Group managing director, Ms Jayne Mati.

Overall, Sh498.9 billion in revenue accounts was not certified by the Auditor-General’s office as required due to audit queries. Out of this amount contained in 57 queries in the accounts, only those concerning Sh3.4 billion were fully answered.

Ms Mati said their analysis of budget figures indicated a pattern over the years, with most of the queries raised by the auditor-general going unanswered.

“Most of the audit queries involving huge amounts of money every year are not answered. The figures seem to double in the election years,” she said.

The amounts collected by Kenya Revenue Authority do not tally with what is received by the exchequer in most cases. For example, the revenue collected in 2007/08 for taxes on income, profits and capital gains has five different figures depending on the institution.

The exchequer shows Sh168 billion, KRA noted Sh166 billion, the amount in ledger records is Sh172.9 billion, amount in revenue statement is Sh177 billion and the amount declared in Parliament by the Finance minister is Sh165 billion.

She said the opening balance figures for the subsequent financial year were understated, and were omitted for the first time in this year’s budget statement.

Grants and loans revenue was reflected as Sh26.7 billion in the auditor-general’s certified accounts, but only Sh20 billion was declared in Parliament, a difference of Sh6 billion that is yet to be accounted for.

The miscellaneous accounts had Sh15.9 billion, but only Sh8.5 billion was declared to Parliament.

Income tax from corporations declared in Parliament was Sh79 billion, while the exchequer account records reflected Sh86.6 billion, an understatement of Sh7.5 billion.