CBK reverses plan on sale of dollar

The Central Bank of Kenya will not, after all, sell dollars directly to importers as it had earlier indicated.

This follows recommendations by a government taskforce to find ways of stabilising the shilling, choosing to stick to a liberalised foreign exchange market, even as the currency continued to weaken.

CBK was planning to start selling foreign currency directly to targeted sectors of the economy said to be most beneficial to the public as one of its measures aimed at stopping further loss in the value of the shilling.

Oil traders were among those targeted. This now leaves importers in the hands of commercial banks whom the CBK is accusing of hoarding foreign exchange to create shortages and maximise on their profits.

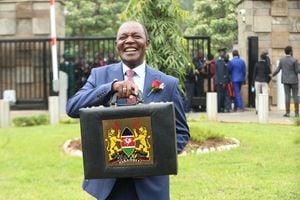

“The government is committed to continue implementing the current exchange arrangement regime of using only the interbank system for allocating foreign exchange,” said Prime Minister Raila Odinga when he presented recommendations by the committee. (READ: Team to present recommendations on weak shilling)

The team comprises officials from the Office of the President, the Treasury, the Central Bank of Kenya, the Planning ministry, the statistics office, the private sector, as well as the secretariat overseeing Kenya’s plan to become a middle-income nation by 2030.

Finance permanent secretary Joseph Kinyua said bypassing commercial banks in selling foreign exchange would be against the liberalised regime that Kenya has subscribed to since the mid-’90s.

Mr Odinga said CBK’s move to raise its lending rate by 400 basis points on Wednesday to 11 per cent was an important step towards stabilising the exchange rate.

The government is also counting on a meeting scheduled for next week with the International Monetary Fund.

“The IMF mission will be in Kenya next week and we shall be asking them to give us between $250 million and $350 million over and above the $500 million extended credit facility we agreed on in February,” Mr Kinyua said.

On Friday, the shilling continued to defy this week’s measures aimed at stabilising it, sliding towards the 104.15 mark, its weakest in history.