KRA loses round one in case against employee

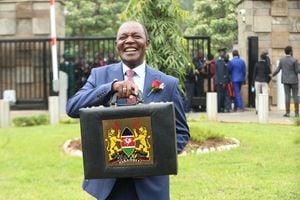

Commissioner-General John Njiraini last week said KRA had dropped the bid to develop the system on the grounds that it should concentrate on its core mandate of collecting taxes. Photo/FILE

What you need to know:

- The case will give an insight into what employees who go beyond the call of duty should expect from their employers.

- KRA is counting on the system to help it go after landlords and property developers as part of efforts to bring the lucrative real estate sector under the tax bracket.

- If the innovator has his way and stops the taxman from implementing a similar system, it would deal it a major blow, coming at a time when KRA is under pressure to meet the ambitious Sh1 trillion tax revenue target set by the government this year.

The High Court on Friday stopped the Kenya Revenue Authority from procuring or implementing a system that would have helped the authority net rental income tax cheats, following a dispute with an employee.

On Thursday Mr Samson Ngengi went to court to force the authority to recognise his effort in developing the system — which they now want to procure from a third party — by issuing him with a certificate of innovation and compensate him.

The High Court on Friday certified the matter as urgent and ordered the taxman to freeze the process of searching for a supplier, or implementing the system, until next month, winning Mr Ngengi round one of the battle.

Temporary reprieve

“We are happy to have got a temporary reprieve until December 5 when the case comes up,” Ms Cathy Mputhia, the lawyer representing the innovator, said in a telephone interview.

Mr Ngengi claims that this was the centre his innovation that links property location, ownership and building details, as well as tax status of a taxpayer, as a single view in a computer application.

This, he claims, would give KRA an insight into how to get its pound of flesh from the lucrative real estate sector. His innovation was named Geo-spatial Revenue Collection Information System (GEOCRIS), and won an international tax award on this basis.

The case will give an insight into what employees who go beyond the call of duty should expect from their employers.

KRA is counting on the system to help it go after landlords and property developers as part of efforts to bring the lucrative real estate sector under the tax bracket.

If the innovator has his way and stops the taxman from implementing a similar system, it would deal it a major blow, coming at a time when KRA is under pressure to meet the ambitious Sh1 trillion tax revenue target set by the government this year.

This has seen KRA in recent days increase its focus to netting more taxes from landlords after income from this segment fell fivefold to about Sh1 billion from over Sh5 billion by 2009.

KRA said it is only looking for a database and not a computerised system like the one developed by its employee.

Commissioner-General John Njiraini last week said KRA had dropped the bid to develop the system on the grounds that it should concentrate on its core mandate of collecting taxes.

He further asked Mr Ngengi to resign if he wanted any dealings with the authority, saying it is not KRA’s policy to trade with its employee, nor to develop systems.

KRA has since transferred Mr Ngengi from Nairobi to Mombasa in a move he says, is meant to silence him.

This is the first tender controversy under Mr Njiraini’s regime, a man who almost single handedly won the fight to make MPs pay taxes on their pay and allowances. He has been named Kenya’s top tax collector.

Mr Njiraini was in charge of domestic and large taxes office when he led the fight to have MPs pay tax on their Sh800,000 a month salary before he was named the new commissioner general.

Mr Ngengi was transferred to Mombasa from Nairobi office and is expected to report today under unclear circumstances.