Developing countries urged to streamline investment channels

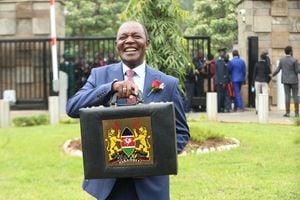

Delegates at the 14th session of the United Nations Conference on Trade and Development at the Kenyatta International Convention Centre in Nairobi on July 19, 2016. PHOTO | SALATON NJAU | NATION MEDIA GROUP

What you need to know:

- United Nations Conference on Trade and Development secretary-general Mukhisa Kituyi told leaders attending the 14th session of the United Nations Conference on Trade and Development (UNCTAD 14) in Nairobi to come up with facilitative measures that will attract foreign investments which have fallen since the 2008 financial crisis.

- He urged government leaders attending the weeklong conference to put investment promotion and business facilitation at the core of investment policies development.

Developing countries have been urged to streamline investment channels to boost low levels of foreign direct investment (FDI) flows needed for crucial for development.

United Nations Conference on Trade and Development secretary-general Mukhisa Kituyi told leaders attending the 14th session of the United Nations Conference on Trade and Development (UNCTAD) in Nairobi to come up with facilitative measures that will attract foreign investments which have fallen since the 2008 financial crisis.

“Improving in investment governance to unlock productive investment should be an issue of central concern to these leaders. Harmonise your investment policies to create a stable and predictable business environment which restore investor confidence and facilitate greater international flows of investment. You should also channel the investments in the direct directions to aid in the attainment of the Sustainable Development Goals (SDGs),” said Dr Kituyi.

He urged government leaders attending the weeklong conference to put investment promotion and business facilitation at the core of investment policies development.

Since 2008, only last year recorded a 36 per cent growth in FDI flow growth driven by mergers and acquisitions or corporate reconfigurations mainly for tax purposes.

Kenya is among the countries which have suffered lowered investment flows, missing out on one of the key driving forces of the global economy.

A report by UK think tank, the Overseas Development Institute (ODI), released a year ago cited poor corporate governance as a key turn off for the international market investing in Kenya even as the country clocked record levels of dollar inflows in 2015.

The report pointed out failures in governance at public and private institutions in Kenya, Ghana and Mozambique as having added to the already poor financial conditions in sub-Saharan Africa.

Kenya saw three institutions fail due to insider loans and fraudulent financial statements while Nigeria corruption allegations have been noted at four major banks linked to former ministers and investigations relating to corruption among central bank officials.

Mozambique saw scandals relating to the “tuna bonds” and undisclosed borrowing from Credit Suisse and VTB, which have caused a collapse in international FDI and other private financing; and Ghana where the public finance concerns have led to currency devaluations, ballooning costs and reduced liquidity in sovereign bonds that has necessitated an International Monetary Fund bailout.

Kenya stood out in the East African region, which witnessed depressed dollar inflows that hit the whole of Africa. FDI flows to Kenya reached a record level of $1.4 billion (Sh142.3 billion) in 2015, resulting from renewed investor confidence in the country’s business climate and booming domestic consumer market.

The World Investment Report 2016 showed that FDI flows to Africa fell to $54 billion (Sh5.5 trillion) in 2015, a decrease of seven per cent over the previous year.

While opening the opening the World Investment Forum, Cabinet Secretary for Ministry of Industry, Trade and Cooperatives Adan Mohamed called out to the developed world to look into the continent.

President Uhuru Kenyatta on Monday was not too cosy with the developed world stating that it was unfortunate that when Africa is opening up and becoming more transparent and accountable, the rest of the world which had benefited from globalisation is now retreating.

“Let us move from excuses and blame game to a position where we now should partner,” President Kenyatta said.

DEEPENING DOWNTURN

ODI in its report on the sub-Saharan Africa economic downturn and its impact on financial development warns that with Brexit, the credit crunch in sub-Saharan Africa is deepening the region’s ongoing economic downturn.

The ODI has estimated that private credit growth in the region has fallen to seven per cent in 2016, less than half of the 2014 peak of 15 per cent. Judith Tyson, Research Fellow at the ODI, said the collapse in oil prices and the slowdown in China that has driven the economic downturn in sub-Saharan Africa, is now having a significant impact on financial markets in the region.

Meanwhile, rich countries have been blamed for curtailing efforts by developing countries to finance SDGs including efforts to end poverty, hunger and poor health.

The UN pointed an accusing finger at the developed states during the ongoing conference in Nairobi.

While announcing a first major effort to measure progress in achieving the new goals, the UN said developing countries would be better able to finance the SDGs if rich countries were meeting their 2002 target to put 0.7 per cent of gross national income into overseas aid.

Dr Kituyi said if rich countries had consistently met the 0.7 per cent target since 2002, then developing countries would have been $2 trillion (Sh203.3 trillion) better off.

“The Sustainable Development Goals represent the outcome of long, serious discussions on how we want our world to look in 2030, but this vision needs serious finance,” he said. “The 0.7 per cent target will be a hard sell for many rich governments, but these are a daring, ambitious set of goals, and they require an equally ambitious response.”

Last year, the international community tasked several institutions to identify the means to finance the SDGs.

A report titled "2016 Development and Globalisation: Facts and Figures" was released at the ongoing Nairobi event with focus on the SDGs with major reflections on the international attention towards the new goals.

At 230, the goals have four times the number of indicators as their predecessors, the Millennium Development Goals (MDGs) compounding the difficulty in measuring progress. UNCTAD Head of Statistics Steve MacFeely, however, said even for the MDGs, the global community was able to measure only 70 per cent of the indicators.

The UNCTAD conference in Nairobi is also considering the options of engaging the private sector in funding the achievement of the SDGs by 2030 which is estimated to be underfunded by Sh250 trillion.