Dissecting M-Akiba: Is it best thing after sliced bread?

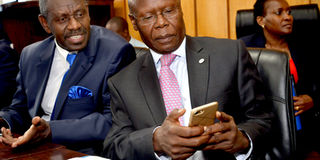

Central Depository and Settlement Corporation (CDSC) board directors Charles Ogalo (right) and Bob Karina during the launch of the M-Akiba at Treasury building in Nairobi on March 23, 2017. PHOTO | SALATON NJAU

What you need to know:

- The minimum amount is Sh3,000 and the interest rate offered is 10 per cent per annum, tax free. The interest is paid every six months. So, if you invest the Sh3,000, you will get Sh150 every six months until April 2020 and then get back your Sh3,000.

- The truth is that the bonds market in Kenya is very slow and buyers are not readily available.

- Let’s wait and see what will happen on Tuesday when it begins trading on the NSE. I suspect that many buyers will feel cheated when they try to sell their M-Akiba Bonds and find no takers.

EVERYBODY IS GOING gaga about M-Akiba, the newly launched Government Infrastructure Bond on sale through mobile phone platform. For sure it is the first of its kind anywhere in the whole world, but is it the best invention after sliced bread?

In summary, this is a new avenue for the public to invest money by lending it to the government. The theory is this: when you keep your money in a bank account, the bank accumulates yours with that from other customers and then lends the millions to the government, earns “huge” interest and pays you “peanuts”.

So, the government decided to cut out the middlemen (that is, banks) and go directly to the public. It’s a good and novel idea on paper, but what about in practice?

The minimum amount is Sh3,000 and the interest rate offered is 10 per cent per annum, tax free. The interest is paid every six months. So, if you invest the Sh3,000, you will get Sh150 every six months until April 2020 and then get back your Sh3,000.

YOUNG MARKET

The question lingering at the back of my mind is whether anybody is willing to lock-in Sh3,000 for a whole three years in order to earn a total of Sh900 in interest. If you invest Sh300,000, you will get a total of Sh90,000 and that looks more enticing!

You can cash out your investment before the maturity date. However, cashing out a Treasury Bond is not a straightforward matter. You have to place it for sale in the secondary market and hope that there is a buyer willing to buy it.

The truth is that the bonds market in Kenya is very slow and buyers are not readily available.

Let’s wait and see what will happen on Tuesday when it begins trading on the NSE. I suspect that many buyers will feel cheated when they try to sell their M-Akiba Bonds and find no takers.

How does M-Akiba compare with other investments in terms of returns? In May 2015, I explained why one should not keep savings in the bank. A Money Market Unit Trust is much better.

In that year, I convinced the members of my “Chama” that we should put some of our cash in a Money Market Unit Trust and on 1st October 2015 we invested Sh242,000 with one of these companies. Since then, we have never added or removed any money from the account.

According to the statement of 31st March 2017, the balance after taxes and management fees now stands at Sh282,201. In other words, we have earned Sh40,201 in just 18 months. This works to a net interest of about 10.8 per cent per annum.

If we had put this money in M-Akiba, we would have been paid Sh12,100 on each of the following dates: 31/Mar/2016, 30/Sep/2016 and 31/Mar/2017. That is a total of Sh36,300.

The greatest advantage, however, is that we can withdraw our money at any time without having to look for a buyer. All it takes is a simple email and the money is out within 72 hours – guaranteed!