Promote mobile banking like Kenya, report urges African states

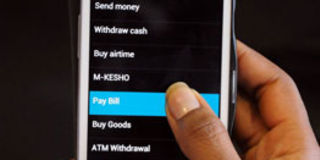

Safaricom M-Pesa menu showing the Pay bill option. November 28, 2012. PHOTO | SALATON NJAU

What you need to know:

- A study released in March this year by the Financial Access Partners indicates that Kenya is the most financially inclusive country compared to many other African countries.

- The survey shows that 77 per cent of Kenya’s population has access to financial service points within 5-km radius. Tanzania has 35 per cent of its population accessing financial services points within 5km while Uganda has 43 per cent of its population accessing financial points within the same distance.

A new report has urged African governments to emulate Kenya in supporting the development of mobile banking and electronic commerce to increase financial inclusion.

The Africa Progress Report 2014, released last week, says the success of the M-Pesa mobile payment platform has greatly enhanced financial inclusion in Kenya.

“African governments can also support the development of mobile banking and e-commerce to overcome financial exclusion, building on successes such as M-Pesa in Kenya. Development finance institutions should work with the private sector to foster more balanced perceptions of risk,” said the report released at the World Economic Forum in Abuja, Nigeria.

It says Africa’s growth has largely been constrained by low levels of access to formal financial systems.

“Only one in five Africans have any form of account at a formal financial institution, with the poor, rural dwellers and women facing the greatest disadvantage. Such financial exclusion undermines opportunities for reducing poverty and boosting growth that benefits all,” the report says.

It also paints a grim picture of access to insurance. It says that productive sectors like agriculture, which lack access to insurance, have constrained growth in many countries on the continent.

African farmers, for instance, who lack insurance, convert their meagre savings into funds for emergencies instead of investing them in boosting productivity.

“Similarly, lacking access to loans and saving institutions, they (African farmers) are often unable to respond to market opportunities,” the report notes, urging governments to adopt innovative technologies to fight financial exclusion.

A study released in March this year by the Financial Access Partners indicates that Kenya is the most financially inclusive country compared to many other African countries.

The survey shows that 77 per cent of Kenya’s population has access to financial service points within 5-km radius. Tanzania has 35 per cent of its population accessing financial services points within 5km while Uganda has 43 per cent of its population accessing financial points within the same distance.

In Kenya, mobile money agents, who represent 75 per cent of total financial service access points in the country, are the biggest drivers of financial inclusion compared to other African peers.

There are, however, questions on the correlation between access to financial points and the use of financial services.

This is due to the fact that financial inclusion is not uniform across Kenya as some areas boast higher inclusion, with others having low rates of inclusion.