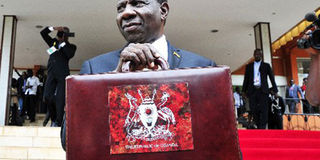

Uganda's Finance minister designate presents record Budget

Uganda's Finance minister designate Matia Kasaija displays his budget briefcase at Kampala Serena Hotel on Wednesday. PHOTO | FAISWAL KASIRYE | NATION MEDIA GROUP

What you need to know:

- Tax increases and a series of mini-giveaways included.

Presenting a record Budget that seeks to put prosperity and better services at the heart of President Yoweri Museveni’s post-election agenda, the Finance minister designate announced a hotchpotch of tax increases and a series of mini-giveaways in a USh26.3 trillion budget for 2016-2017 fiscal year.

In view of the delays in appointment of a new Cabinet, there was no legitimate Finance minister. But, circumventing the legal challenge, the President delegated Buyanja Member of Parliament Matia Kasaija, whom he reappointed to the ministry this week to help him read the tax-filled Budget.

With effect from next month, motorists in the country will pay an extra USh100 on each litre of diesel and petrol as a result of the new amendments to the excise duty law. A litre of petrol will increase from about USh3,300 to USh3,400 and diesel from about USh2,700 to Sh2,800. Although this increase looks minimal, any tax on fuel has an effect on the economy.

Smokers have not been spared with tax imposed on cigarettes. Twenty per cent tax was also imposed on sweets and confectionaries.

Stamp duty on transfer of property has also been increased from one per cent to 1.5 per cent, starting next month.

By targeting the rich to help the government finance the Budget, the minister designate has increased registration fees for personalised number plates USh5 million to USh20 million.

Mr Kasaija’s Budget, however, had some mini-giveaways facilitating investment, particularly in petroleum, mining and construction. For instance, taxpayers who merge or acquire loss-making businesses, will be allowed tax relief for such losses.

Although economists and politicians have criticised the new Budget for “spreading pain” through deepening the tax base as opposed to widening it, Mr Kasaija said the government strategy was to expand the tax base by gradually formalising the large informal sector, improving efficiency in tax collection and compliance.

Relief on value-added tax will also be granted for supplies procured from the domestic market for aid-funded projects.