How big shots took a handful of Kenya Seed

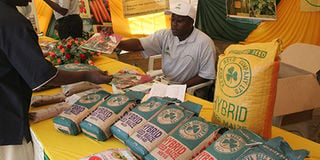

An audit report on the 2001 acquisition of the Kenya Seed Company suggests a formerly powerful family used the management and even seed growers to acquire substantial shares in the cash-rich parastatal. PHOTO/ CORRESPONDENT

An audit report on the 2001 acquisition of the Kenya Seed Company suggests a formerly powerful family used the management and even seed growers to acquire substantial shares in the cash-rich parastatal.

However, the PricewaterhouseCoopers dossier is inconclusive on how the State can reverse what is seen as an illegality without getting entangled in further litigation.

Of the Sh134.7 million raised in the controversial private placement last week and declared by Agriculture minister William Ruto to have been irregular, Sh40 million (30 per cent) is reported to have originated with the then-powerful politician.

Then managing director Nathaniel Tum is quoted by the report as saying the money was paid through a top manager of the company.

Impact of sale

Another cheque for Sh20 million (12.5 per cent) is believed to have been paid through a Nairobi law firm by a son of the same politician.

Kenya Seed had issued 4 million shares seeking to raise Sh160 million, 3.4 million of which were paid for.

The impact of the sale was the reduction of the stake of parastatal Agriculture Development Corporation(ADC) from 53 to 40 per cent and that of the KFA from 14.9 to 11.3 per cent.

Tum and Associates’ stake rose from 17.8 to 29.5 per cent and that of “others” from 14.4 to 18.9 per cent.

The report found no documentary proof that the State had sanctioned the transaction.

Then Head of Civil Service Richard Leakey had recommended that Kenya Seed shares be floated at the bourse, but officials claimed US giant Monsanto was then coming to Kenya and would snap up the shares.

After suggesting there is ample evidence to conclude the firm was State-owned, the report recommends ADC, Kenya Seed and the State co-operate to reverse the sale, also the subject of an investigation by the Inspectorate of State Corporations.

It deems the Sh40 per share pricing by Deloitte Touche as contestable as the firm was not given adequate time and information to do a proper valuation. The placement took place a year after valuation.

However, it also points out its own inadequacies as some of the parties involved in the controversial transaction declined to disclose information, and Kenya Seed records were destroyed by a fire in 2004.

The ADC-commissioned audit finds that of the 81 subscribers to the issue, only eight met the criteria for participation. According the prospectus, only existing shareholders, employees, seed growers and agents were eligible.

There were three certified lists issued by two officials of the firm with subscribers varying from 47 to 81.

Curiously, some of the senior Kenya Seed managers were involved in designing the placement and later became beneficiaries.

The audit finds the deal irregular because the government did not offer the requested consent — a number of Kenya Seed directors refused to sign a responsibility statement.

The ADC never waived its pre-emptive right even though managing director Job Siror participated in the placement meetings.

And despite lack of privatisation laws, a government white paper on the subject had not listed Kenya Seed for privatisation as it was deemed strategic.