Where sugar mills have gone silent, killing livelihoods

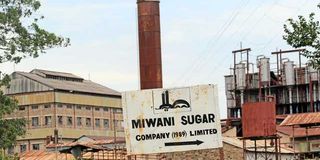

A dilapidated Miwani Sugar Company in Kisumu County in this September 2016 photo. PHOTO | FILE | NATION MEDIA GROUP

What you need to know:

- The Kenyan sugar industry comprises 14 milling factories, five of which are public-owned and have been in financial distress over the past 10 years.

The millers have total outstanding loans, taxes, penalties and fines due to the government amounting to Sh90.4 billion.

Sony sugar has an outstanding debt of Sh6.2 billion, while Chemelil Sugar’s debt stands at Sh6.1 billion.

The dark smoke billowing from the smokestacks of Muhoroni Sugar factory has become synonymous with the company that was established when the country gained independence in 1963.

For regular folk visiting the small town located at the edge of Kisumu County, one would imagine that the company has fully resumed operations after years of a downturn that almost brought it to a halt.

Unknown to many, the troubled miller is at times forced to roar its machines without milling the sweetener to avoid corrosion of the machine parts.

“It is very dangerous to keep the machine idle for a long time as this could lead to more breakdowns due to possibilities of critical components of the machine rusting,” said Mr Francis Ooko, the receiver manager.

The old rusty-iron-sheet-roofed houses dotting Muhoroni Township tell the sad tale of the crumbling sugar industry, whose fortunes have suffered a steady downturn over the years.

This scenario is a replica of what is happening in western Kenya’s sugar belt, which once boasted of six state-owned sugar millers – Mumias, Muhoroni, Chemelil, Nzoia, Sony and Miwani.

AILING INDUSTRY

Cane farmers in Western region have little to cheer about, even as the government pushes ahead with efforts to address challenges that have driven the ailing sugar industry to the verge of collapse.

For slightly over a decade now, the country’s once lucrative sugar sector has been on a steady decline, forcing Kenya to look outside to bridge its rising demand for the sweetener.

The sad tale is best explained by the current status of public-owned factories, which are a far cry from what they used to be.

The Kenyan sugar industry comprises 14 milling factories, five of which are public-owned and have been in financial distress over the past 10 years.

According to the sugar task force report that was presented to President Uhuru Kenyatta, the affected sugar millers include Chemelil Sugar Company, Miwani Sugar Company (in receivership), Muhoroni Sugar Company (in receivership), Nzoia Sugar Company and South Nyanza Sugar Company (Sony).

The millers have total outstanding loans, taxes, penalties and fines due to the government amounting to Sh90.4 billion.

Miwani Sugar has the highest outstanding debt at Sh27 billion, followed by Muhoroni Sugar at Sh25.1 billion and Nzoia Sugar at Sh21.2 billion.

SH6.2 BILLION DEBT

Sony sugar has an outstanding debt of Sh6.2 billion, while Chemelil Sugar’s debt stands at Sh6.1 billion.

Mumias Sugar Company, which is listed on the Nairobi Securities Exchange but currently in receivership, has debts amounting to Sh4.8 billion, excluding taxes, penalties and fines. The government has a 20 per cent stake in the sugar factory.

Political interference

Experts attribute the situation to plunder, mismanagement and political interference which, they note, has had a devastating effect on the livelihoods of more than 400,000 smallholder farmers who supply over 90 per cent of the milled cane, and thousands of workers who have been rendered jobless.

Most of the state-owned companies have been performing dismally for lack of sufficient capital and failure to conduct routine maintenance, leading to outdated machinery, argued Sugar Campaign for Change coordinator Michael Arum.

Muhoroni Sugar Company, which is now struggling to cater for its overhead costs, currently operates up to three times a week due to a biting shortage of sugar cane.

Due to a myriad of challenges, the company, which has an installed capacity to crush 2,200 tonnes of cane per day, is currently doing less than 500 tonnes in 24 hours.

OVERHEAD COSTS

The situation is even direr for the neighbouring Chemelil Sugar Company, which is struggling to survive and cater for its overhead costs and the accumulation of unremitted statutory deductions owed to the Kenya Revenue Authority (KRA).

The performance of the miller has also been affected by lack of funds to carry out maintenance.

In the past 19 years, the company’s managing director Gabriel Nyangweso indicates, the miller has conducted maintenance five times only, instead of doing it annually.

This has significantly affected its efficiency because the company has experienced declining cane supply, depressed factory sugar price and high costs of production, Mr Nyangweso said.

A trip to the nearby Miwani Sugar Company, which went into receivership in 2000, depicts a bitter life for the residents whose hopes and economic lifeline have been crushed.

The bleached bricks on the buildings and the giant chimneys lying in deep neglect sum up the fate of the pioneer miller of the once most promising sugar belt in the country.

In efforts to address the situation, the government has begun leasing out the five state-owned sugar millers as part of a revival strategy.

EXPRESSED OPTIMISM

Kenya Sugarcane Growers Association (Kesga) has expressed optimism that the initiative will bring back the lost glory of the once lucrative sector.

“In its heyday, Muhoroni town was a beehive of activity and was the economic backbone of this region as traders experienced booming businesses due to high circulation of money,” said Kesga secretary-general Richard Ogendo. He pointed out that both farmers and workers of Muhoroni and the neighbouring Chemelil and Miwani factories were paid on time without any hitches.

But the planned leasing of five state-owned millers in the region is turning political, with cane farmers now demanding that they should process go on, barely a week after governors from the region called for its suspension to allow for more consultations.

Farmers accuse governors from the region of political interference and of sabotaging the leasing process, even before it kicks off, to serve their selfish interests.

The cane growers have urged the government to ignore the county chiefs and politicians opposed to the process and proceed with the leasing.

According to an advert by the Agriculture and Food Authority (AFA) published on July 10, the government is looking for investors with world-class experience to redevelop the factories into large sugar complexes and manage them in a 25-year leasehold.

The selected financier is expected to lease, redevelop and operate the sugar complexes at sufficient processing capacities to support diversification into co-generation of export power, production of bio-ethanol and allied products.

COST OF PRODUCTION

Successful bidders for the running and management of the five millers will be unveiled on August 4.

The national sugar task force report presented to President Kenyatta in February 2020 outlined the challenges threatening the sustainability of the sector, among them the high cost of production, inadequate cane supply and low productivity.

Other challenges identified through stakeholder hearings were inadequate regulatory framework, poor governance, indebtedness, uncontrolled and illegal sugar imports, ageing equipment and delayed payment to farmers, employees and suppliers.

The sugar task force report noted that there has been a decline in area under cane since 2015, from 223,605 hectares to 191,215 hectares in 2018.

As residents peg their hopes on the leasing of factories to rekindle the potential of the sleeping giants, the creeping plants and unkempt vegetation continue to occupy the parking lots that were once reserved for the top managers.

Reported by Benson Amadala, Victor Raballa and Caroline Wafula