Economy will take a beating from tax increase, say experts

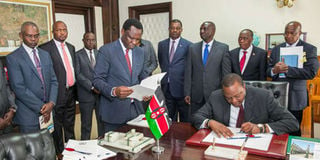

President Uhuru Kenyatta signs into law the Finance Bill 2018 at State House Nairobi, on September, 21, 2018. PHOTO | PSCU

What you need to know:

- Treasury Cabinet Secretary Henry Rotich is aiming to raise in the order of Sh130 billion from the new taxes and levies.

- Mr Rotich is eyeing about Sh473 million from imposition of Sh20 excise duty on every kilogramme of sugar confectionery.

- The painful taxation measures and the Sh37.60 billion are aimed at reducing the deficit in government budget.

Increased taxes and levies, coupled with uncertainty over Kenya’s engagement with the IMF, will likely hurt creation of new job opportunities, initial analysis by economists and investment analysts has suggested.

President Uhuru Kenyatta on Friday signed into law the Finance Act 2018 which comes with several new taxes and levies aimed at growing government revenue and reducing the budget deficit as demanded by the International Monetary Fund.

The signing of the law, which spells out sources of revenue to fund the budget, has seen imposition of new taxes and increment of others in a bid to realise an ambitious Sh1.69 trillion ordinary revenue — taxes, levies, fees, commissions and penalties.

RAISE SH9.8 BILLION

Initial calculations have shown Treasury Cabinet Secretary Henry Rotich is aiming to raise in the order of Sh130 billion from the new taxes and levies.

They include Sh18 adulteration fee per litre of kerosene, largely consumed in poor homes for lighting and cooking, targeting to raise Sh9.8 billion and the eight per cent value added tax (VAT) on petroleum products expected to yield Sh17.5 billion.

Mr Rotich is also eyeing about Sh473 million from imposition of Sh20 excise duty on every kilogramme of sugar confectionery, which include sweets and chocolates, purchased. The biggest new revenue stream is, however, the 1.5 per cent National Housing Development Fund cut from gross monthly earnings of employees, matched by employers, which is targeting about Sh57 billion.

The doubling of duty on money transfers to 20 per cent, increasing tax on making a call on mobile phone and using Internet to 15 per cent from 10 per cent and the 12 per cent tax on transferring cash on mobile phone is also likely reduce the purchasing power of consumers.

NEW TAXES

Investors however see these new taxes, together with the existing ones, piling more costs and likely to eat into their profit.

“The mood is so negative. In the 12 years I’ve been back (to Kenya), I can’t recall such a loss of faith. Four companies I speak to are at a board level decision process to transfer to Rwanda,” Mr Aly-Khan Satchu, an investment analyst and chief executive of Rich Management, said on his twitter handle earlier in the week.

Kenyan manufacturers, most of which are slow to automation, the additional tax costs and reduced purchasing power of consumers are likely to eat into their revenue, hurt new investments and slow down new job opportunities. Sachsen Gudka, the chairman of Kenya Association of Manufacturers (KAM) said consumption of goods may go down as consumers tighten their belts.

That, if it happens, will see prices of goods and services at average of about two per cent, estimates by KAM suggested on Friday.

NEW INVESTMENTS

Mr Gudka, an industrialist in packaging sub-sector who rose to lead KAM in July, claimed that, while neighbouring countries such as Ethiopia, Rwanda and Uganda are attracting new investments by lowering the cost of production such as electricity and labour, Kenya is raising the costs.

That, he said, goes against the Mr Kenyatta’s Big Four Agenda where the manufacturing sector is expected to create 800,000 new quality jobs by 2022.

The employment opportunities are largely expected to be generated from fresh investment in additional 1,000 small- and medium-sized (SMEs) factories in agro-processing, leather, textiles and fish-processing.

“These new tax measures will also impact job creation significantly,” Mr Gudka said. “Over the years, we have unfortunately seen an exodus of investors from Kenya to neighbouring countries, some opting to move their operations to other countries but sell their final products here, meaning that no jobs are created and more money goes out instead of circulating within the local economy. Other companies have simply shutdown completely.”

PAINFUL TAXATION

The painful taxation measures and the Sh37.60 billion are aimed at reducing the deficit in government budget, which is bridged through borrowing, to 5.7 per cent of the gross domestic product — national wealth — from more than six per cent presently.

The supplementary estimates passed in a chaotic special National Assembly sitting last Thursday, however, left Mr Rotich with a hole of Sh17.73 billion to achieve the targeted 5.7 per cent fiscal deficit.

This was after the MPs cut the nearly Sh3.03 trillion budget they approved in June to Sh2.99 trillion as opposed to Sh2.97 trillion Mr Rotich had proposed.

Lack of a clear road map to cut the deficit to three per cent was one of the main reasons the IMF did not extend the $989.8 million (Sh99.81 billion) standby loan to Kenya, which was to be tapped in case the shilling comes under pressure from increased foreign debt repayments and imports.

IMF PROGRAMMES

While Mr Rotich has publicly insisted that the country’s management of public funds is prudent, he appears to have confided in members of the Budget and Appropriation committee chaired by Kikuyu legislator Kimani Ichungw’ah, that the painful measures will not only ensure the country gets back IMF programmes, but also “demonstrate that we are disciplined in terms of fiscal management”.

Jibran Qureishi, an economist for East Africa at Stanbic Bank, said the taxation measures are “a harsh and painful reality” of how Kenya has mismanaged public finances through increased external borrowing which has not resulted in increased foreign direct investment flows.

Ambitious revenue targets which are not usually met have over the last five years raised the appetite for borrowing to spend on projects which have not yielded the targeted impact on economic growth, Mr Qureishi said.

PUBLIC FINANCING

“It is a bit of a wake-up call when it comes to public financing. We need to think about everything holistically from how much we pay for projects, re-assess what we are paying for, the costs for it and do stringent feasibility study to ensure there’s multiplier effect on the wider economy,” he said.

The economist however maintained Stanbic’s 5.6 per cent economic growth outlook for Kenya this year, rising to 5.9 per cent next year, largely on improved agricultural output, strong exports earnings and tourism receipts.

The bank’s growth outlook is lower than Treasury which has upgraded its projection to six per cent from 5.8 per cent in June, rising to 6.2 per cent in 2019, citing the same drivers.