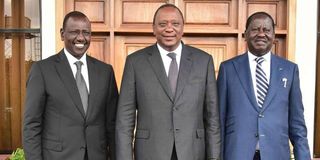

County cash stalemate: All eyes on Senate, Uhuru, Raila and Ruto

President Uhuru Kenyatta (centre) Deputy President William Ruto (left) and ODM leader Raila Odinga at a past function.

What you need to know:

- Beneath the acrimonious formula and debate on the disbursement of cash to the counties is a widening crack that has exposed the weak links in national politics.

But how the BBI will be used as a red herring or as a Trojan horse by the various political camps remains to be seen and President Kenyatta wants this matter concluded fast.

When the Senate meets Tuesday, all eyes will be on the voting patterns, the political horse trading and hidden dynamics that will emerge out of the revenue-sharing debate.

For beneath the acrimonious formula and debate on the disbursement of cash to the counties is a widening crack that has exposed the weak links in national politics.

As senators go back to the House, divided on an acrimonious formula that will be used to share out Sh316.5 billion allocated to counties this financial year, the position of the main political players — President Kenyatta, former Prime Minister Raila Odinga and Deputy President William Ruto — will either pass or sink the debate. This is their Achilles’ heel. Above the din of the revenue debate, the shape and face of the Uhuru succession debate will be made. (See separate stories)

With opposition to the formula coming from mainly the northern and coast counties, it will be interesting to watch who will throw these counties under the bus — and with what consequences.

2022 POLITICS

The proposed third basis formula is not only embroiled in 2022 politics, but threatens to dry the county coffers since they cannot get any funding after July 1 without the Senate’s approval.

Senate Majority Whip Irungu Kang’ata has already warned that the fate of the Building Bridges Initiative (BBI) will now rest on the success or failure of this formula, echoing a perspective held by some of the politicians pushing for the new plan. But he has also been accused of trying to blackmail regions that are seeking further discussions.

“We shall bite the bullet and shall not negotiate any further. We have tried to pass this thing five times and we need to settle this discussion,” said Mr Kang’ata. “If for any reason that proposal is defeated, those of us who support (Uhuru Kenyatta) will say there is no need for BBI which stands for one man, one vote, one shilling.”

But how the BBI will be used as a red herring or as a Trojan horse by the various political camps remains to be seen and President Kenyatta wants this matter concluded fast.

The first basis for revenue sharing, and which was approved in November 2012 had considered four parameters — poverty levels, land area, basic equal share and fiscal responsibility — as the basis for sharing. The second basis, approved in 2016, added a development factor and its aim was to correct economic disparities and promote economic optimisation.

And now the Commission for Revenue Allocation’s new proposal has broken down the parameters to include health, agriculture, land, roads, fiscal prudence, poverty levels and urban service.

Although the new formula, developed by CRA, was presented to the Senate in December, after the expiry of the second basis formula, the senators have yet to pass it as the first step to the enactment of the County Allocation of Revenue Bill 2020.

NEW FORMULA

Those who are for a new formula argue that the previous one had created serious per capita inequalities across the counties, with Lamu having the highest per capita allocation (Sh24,653) compared to Nairobi which had an allocation of Sh3,591. Thus, a person in Lamu is allocated more than eight times the money a person in Nairobi is allocated.

Other areas with high per capita allocation included Tana River (Sh17,591), Marsabit (Sh15,229), Isiolo (Sh14,516) and Samburu (Sh14,266), compared to the lowest allocation in Nairobi (Sh3,591), Kiambu (Sh3,870), Nakuru (Sh4,371), Uasin Gishu (Sh5,102) and Meru (Sh5,180).

But even if the new formula was used to share the revenue for last year, Tana River would still emerge at the top with a per capita allocation of Sh13,428 compared to Nairobi with Sh4,723.

“Save for Lamu, the third basis formula continues to advantage sparsely populated and geographically expansive counties at the expense of densely populated ones,” says a review document.

The other problem cited about the previous formula is that it did not allocate money to specific devolved functions and that left the counties to budget without any regard to the revenue sharing formula passed by the Senate.

Politicians have also felt that areas with large tracts of land and sparse populations received more money on account of uninhabited land — even where such lands are either lakes, national parks or reserves.

It is these tricky issues that now haunt the third basis formula, which comes at a time politics of succession are in top gear.

SEVEN PER CENT

In the new CRA formula, the highest per capita allocation gap has been brought down from eight times over to three times over, though pundits still claim that this is still high.

With CRA directing specific allocations to health and agriculture, the idea was to ensure that funds allocated to county governments are spent for their intended purpose.

Previously, the counties’ land mass allocation was fixed at eight per cent but this has now been capped at seven per cent. With the previous formula, three counties with a large land mass received 34 per cent of the allocation, but will now get 21 per cent. The balance of 13 per cent will be re-allocated to the other counties.

This has been criticised since 12 per cent of the counties will receive 70 per cent of funds on this parameter while the remaining 35 counties will only get 30 per cent.

In the previous formula, the ratio of money shared on the poverty parameter meant that if two counties shared the same average poverty index, they received equal allocations without regard to the population or other inequalities.

Interestingly, this formula is widely being supported by most of the counties in the Mt Kenya region with a feeling that the one man, one vote, one shilling will favour them.

“Based on the existing formula, Mt Kenya gets nearly all its revenue share compared to its 2019 population. The region has 18 per cent of the country’s population and it gets 17 per cent of the revenue, fulfilling its one man one shilling demand,” wrote Billow Kerrow, a former Mandera Senator on his Twitter handle. “The proposed new formula is crafted to give more money to developed areas to maintain their roads, hospitals, etc. Those who have shall have more. Its inequitable."

Vocal Nandi Senator Samson Cherargei wrote yesterday: “One man, one shilling. We must not punish counties because they are populous; money is allocated to people not anything else” an indicator of how the revenue sharing divide is not informed by local politics.

While the second generation formula laid emphasis on rewarding counties that collected higher revenue but also raised the amount of money to be equally shared by the devolved units, the implication of the third formula is that the number of counties that have been receiving a higher allocation because of their huge landmass and high poverty indices will receive less.

But it is a tricky balance for politicians.