Nowhere to hide after lenders go for my allies

I had borrowed the money to help me travel to Nairobi for passport and visa processing. ILLUSTRATION | J. NYAGAH | NATION MEDIA GROUP

What you need to know:

- I made some money in December, but not enough to offset my debts, especially since I had to visit Cosmos every day.

- You can’t be driving a car only to drink at Hitler’s and eat kunde in your house.

- Soon, the lenders started bombarding me with messages.

You will all remember last December when my car was up and running. It was a great and proud moment; and a convenient time for me and the larger family.

I relished giving lifts to people I thought were deserving; and denying those I considered enemies of progress. Like Kuya. I once passed him when it was raining. It was a good feeling.

GREAT EXPERIENCE

However, all this was at a great experience to the pocket. You all know that I had borrowed heavily, from the Sacco and other sources that I won’t reveal here, to purchase the car, and to pay Ali to have the thing moving.

In fact, I still owe Ali some money for repairs. Also, I am yet to complete paying Bensouda the balance. If there is a friend of hers here, you may want to tell her that I have no plans of ever paying her. If anything, she should actually refund me some money for having sold me a shell of a car.

Of course, I made some money in December, but not enough to offset my debts, especially since I had to visit Cosmos every day. And we had to eat well.

CAR OWNERS

You can’t be driving a car only to drink at Hitler’s and eat kunde in your house. We had to eat like proper car owners.

Then Pius arrived. You will remember that when the car broke down, he downloaded various icons on my phone that could give me instant loans. I had initially been using one but, clearly, one is never enough.

“Sometimes you have money, sometimes you don’t,” he told me. “You borrow from one, and pay another, then after paying that one, they will be happy and lend you even more.”

“But I have enough debts already,” I protested. “Why should I take more?”

“Usiogope deni, hata serikali hukopa, wewe ni nani?” he assured me, then added: “In fact when you hear the government owes Sh 5 trillion, it includes all money that Kenyans owe others, including your Sh25,000.”

BORROWING

I went to work, borrowing from one app to pay another — and borrowing some more. For the next few months, I was able to manage all these.

“Dear Andrew, this is to remind you that your loan of Sh 6,200 is due on April 23, 2019. Please make arrangements to clear this loan and increase your limit”

My phone was flooded with such SMSs daily but I did not care, an SMS never killed anyone. It can simply be ignored, or better still, deleted. Furthermore, I had not defaulted.

Until mid-last month. I just had no money to settle Sh7,200 loan on one of the apps on my phone. And Sh6,200 on another. Plus I owed two others a total of Sh 14,700 but I had not defaulted yet; I still had a few days.

I know some enemies of my progress will call me an irresponsible borrower. I am far from it. I had borrowed the money to help me travel to Nairobi for passport and visa processing. I will soon be refunded and pay back my loans.

LENDERS

Soon, the lenders started bombarding me with messages. Every morning, I woke up to find messages on my phone, reminding me to pay, and giving unspecified consequences. I was happy to realise that I was not alone, when I discussed it with friends at Hitler’s during Easter.

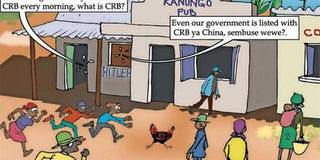

“These people are useless,” said Kuya. “They are threatening to send my name to CRB every morning, what is CRB?” he asked.

Saphire explained that CRB is a body that keeps a record of all loan defaulters and communicates to lenders so that none of them lends you again.

“Uh, hiyo tu?” asked Kuya. “I though it is something serious,”

“It is not,” said Sapire. “Even our government is listed with CRB ya China, sembuse wewe?

Nyayo had a brilliant idea. “Ningekuwa nyinyi ningebadilisha number ya simu, kwani watanipata wapi?” it made sense. And so two weeks ago, I bought a new line, and threw away the old one that was receiving many loan messages.

DISTRESSED

Last week I did not go to school on Monday. When I arrived at home that evening, Fiolina, the laugh of my life, told me that two colleagues of mine (Lena and Nzomo) had called, wanting to speak to me urgently.” They sounded distressed,” she added.

They were waiting for me when I arrived in school the next day. “What happened to your phone, Dre,” Nzomo was the first to talk. “I have been unable to reach you for over a week.”

“Branton blocked it when playing,” I said. “And I bought a new one.” To my shock, both Nzomo and Lena showed me messages they had received from one loan app asking them to remind me to pay my loan.

“Ati usipolipa, wote tutawekwa CRB,” complained Nzomo.

BIG ISSUE

“Please pay,” pleaded Lena, her bad hair in tow. “I don’t want my name spoilt at CRB.” I told them being listed at CRB was not a big issue. “Anyway, I will pay when funds become available,” I assured them.

“Uko na bahati sana,” Saphire told me later that day when we met at Hitler’s. “Your people that were contacted are afraid of CRB and may pay for you.”

He went on: “For me, they called Tecla who told them to do what they wanted to do. He even said that he didn’t know me!”

From the look of things, Lena and Nzomo will have to pay for the loans. So that I can borrow again!