Here is a sure way to stretch your money

This will give you time as you figure out your next steps, especially if your income has been affected. ILLUSTRATION | COURTESY

What you need to know:

- Categorising this way keeps you prepared and can also show you where you can release more money for savings, investments, or even emergencies.

Have you noticed that with soap or shower gel, you tend to use less the emptier the bottle is?

When you have a new one you use it lavishly, often leaving suds all over the place as you shower. When the bottle is about midway you use it more moderately but you are still generous.

However, towards the end, you use it very sparingly but still get clean. It even makes you realise how wasteful you had been when the bottle was new and how much you can do with a little.

The same concept applies to our money, but often we are not aware enough to know how and when to regulate our money.

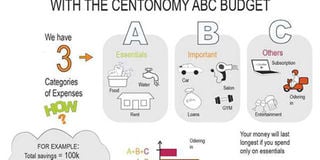

Just like the soap, there are times when we need to apply the brakes on spending and therefore need to categorise our expenses. At Centonomy, we developed a concept known as the ABC Budget, which categorises your expenses into these three parts (ABC).

Think of this as the moment when you are running low on soap. You probably even spend less time in the shower at this point.

BUDGET RULE

When you are running low on money you want to just focus on your essentials, for example food, water, rent.

Even with food, you may go deeper and look at what foods are essential, for example milk and bread, rather than junk food. Your A expenses are your absolute must-haves to function.

The expenses in this category are important but if push came to shove you can find an alternative or do without them for a while.

An example of this is going to the gym. It's great for you but if you can't afford to (or physically can't, like is the case in this social distancing period) you can exercise at home or run outside.

This is the point when the shower gel bottle is full. You know you are being lavish with use but you are simply just enjoying that long shower where you come out smelling good.

Expenses in this category are entertainment, eating out, et cetera. They bring enjoyment to your life but you do have the option of cutting them out without your life significantly falling apart.

The illustration herein shows how your money can stretch by applying this to your life. In essence, to make your savings or resources last longer, cut what you can from your B's and C's.

FINANCIAL PRUDENCE

This will give you time as you figure out your next steps, especially if your income has been affected. It will even let you know what you need to replace the income that is lost with.

Even if your income has not changed, categorising this way keeps you prepared and can also show you where you can release more money for savings, investments, or even emergencies.

Some expenses may vary from situation to situation, for example loans are depicted as a B expense because many banks in this season have been willing to restructure loan terms but this depends on negotiations with your bank.

If they are not flexible on this, loans should be treated as an A. So do go ahead and use this to get some awareness and control over your money.

Waceke's book Making Cents is now on sale at selected bookstores and also available for order. For queries get in touch through [email protected]