Pensioners' agony as crooks mint millions

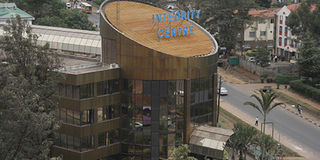

Integrity Centre in Nairobi where the Kenya Anti-Corruption Commission offices are located. Photo/FILE

An investigation into the Sh26 billion-a-year government pension system has exposed incompetence and corruption, which is condemning thousands of retired civil servants to poverty. Loopholes, which may have been used by conmen to pay ghost retirees millions of shillings, have also been unearthed by the Kenya Anti-Corruption Commission.

Some Sh400 million of pension money is in suspense accounts, some of it because incompetent staff sent cheques to wrong address, the investigation by the commission found. A department, which this year will manage Sh26 billion for 180,000 pensioners, has only three qualified accountants, according to a report of the investigation.

In its management ranks, there were 24 positions vacant. The commission’s report reveals that corruption networks have infiltrated pensions, fleecing retirees of their benefits or delaying payment. It also points to the possibility that the Pensions Department could be paying millions to ghost pensioners in foreign countries.

In one case in the 2005/2006 financial year, the department sent Sh79 million to pensioners in the UK through an agency, without supporting documents. Efforts by commission to get details of the UK “pensioners” were fruitless and no one came forward to confirm receiving their pension, according to the Report of the Examination into the Systems, Policies, Procedures and Practices of the Pensions Department, Ministry of Finance.

“The payment of such pensioners in the UK without proper verification of their existence is a loophole for payment of non-existent pensioners,” said the report, which was given to the department in November 2008 but kept secret. The commission termed the payment an abuse of the Government Financial Management Act of 2004, which requires public institutions to obtain adequate supporting documents for payments.

“Payment of commission to agents is based on the pensioners paid and this could be a double loss to the government in case ghost foreign pensioners are paid,” said the report. It also suggested that the director of pensions stops payment of overseas pension where relevant verification details and documents are missing.

The revelations would raise questions over the department’s ability to manage pension issues, especially with the expected contributory pension scheme the government hopes to start in July. Already, the Kenya National Union of Teachers has questioned how the new pension scheme is going to be run and demanded that mechanisms be put in place to ensure the money is safe.

Pensions Department spokesman Michael Obonyo said problems identified by graft watchdog would all be solved by a new computer system, the Pensions Management Department Information System. It will speed up the processing of pensions and improve keeping of records. “All manual file information will be digitised to enable us access client information at the touch of a button,” he said.

Mr Obonyo said the department will be ready to manage the new contributory pension scheme as “we are putting in place many reforms that will enable us handle as many clients as possible”. The commission’s report said pensioners and some members of staff at the pensions department were aware of corruption networks that delayed payments.

They included “brokers” who worked with officers of the pensions department to defraud retirees of their pensions. There were also pension officers in the ministries and officers of the pensions departments. Some networks were between relevant ministries’ staff, pensions staff and staff of the Kenya Revenue Authority who prepare clearance certificates for pensioners.

To beat the cartels, the report proposed that the Finance permanent secretary and other authorised officers in ministries ensure that all “members of staff who perform pensions duties are frequently rotated to deter syndicated corruption.” In some cases, the report said, members of staff leaked information on payments meant for pensioners, including amounts to be paid and the accounts where the cash would be channelled to.

“This exposes pensioners and dependants to various risks,” said the report. The report said the department had accumulated a huge suspense account as a result of returned cheques because pensioners could not be traced. The cheques were returned because accounts were closed or the department was slow to respond to requests to send the money to a different account.

Cheques have also been posted to the wrong address or pensioners have failed to collect their money at designated paypoints, all contributing to huge amounts being held in a suspense account. By mid 2007, Sh465 million went to the suspense account. The report recommended that the department publish in the local newspapers names and relevant details of pensioners whose benefits were held.

“The pensions department should instruct banks to clearly give details of the pensioners whose dues are returned to the department,” said the report. The report said Sh170 million against pension cheques dating back to 2006, was being held at the pensions department.

Status of cheques

The money is in respect of cheques dispatched to various institutions for payment of pensioners “but they have neither been presented to the bank for payment nor returned to the department”. “The department has not made any effort to contact the institutions to establish the status of the said cheques even though they are known to them,” the report said.

There are times when lack of adequate verification in calculating pension arrears opens an opportunity for payroll officers to pay exaggerated pension arrears in collusion with pensioners. The commission proposes that PSs ensure employees are informed of their retirement a year in advance to give time for processing pensions.

The department’s budget, which stood at Sh23 billion during the 2007/2008 financial year, rose to Sh26 billion this financial period. The report, completed in February last year, said the department processes about 2,000 files for new pensioners monthly.