Audit review underway as row rages over Ifmis

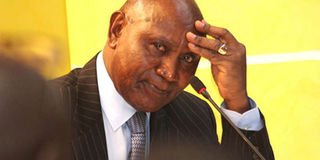

Auditor General Edward Ouko. He has called the reliability of the Integrated Financial Management System into question. PHOTO | FILE | NATION MEDIA GROUP

What you need to know:

- The system has been at the centre of some of the largest graft heists to hit Kenya in recent months, both at the national and county levels.

- An audit released in November 2016 revealed that the system has numerous control weaknesses that badly expose it to fraud and misuse.

During this year’s devolution conference in Kirinyaga County, Auditor General Edward Ouko made a startling admission on the efficiency of the software that is currently being relied on to manage the country’s finances.

He said that the Integrated Financial Management System (Ifmis) — the nerve centre that is meant to enhance efficiency in planning, budgeting, procurement, expenditure and reporting in the national and county governments — is not efficient in investigating the use of public funds in counties.

Mr Ouko further said that the information generated by the system is often inaccurate and gives a misleading picture of the financial status of regional governments.

“It is not the counties’ fault that there are these differences. Now, we need to go back and decide whether the Ifmis system conceived when we had the unitary government is still applicable when we have two levels of government,” he said.

GRAFT

It is this admission that lifted the lid on the operations, management and integrity of the controversial system.

The system is created to provide audit trails of all financial transactions with details of the person who logged in, the time, the computer used and the action performed.

But it has been right at the centre of some of the largest graft heists to hit Kenya in recent months, both at the national and county levels.

This has led to mounting questions over its rigour in guaranteeing accountability.

Annual audit reports released by Mr Ouko's office flag huge variations recorded between Ifmis and the statements of counties’ financial transactions.

An audit released in November 2016 revealed that the system has numerous control weaknesses that badly expose it to fraud and misuse.

INSECURE

It established that unidentified users are capable of logging in remotely while others have multiple identities.

The audit further revealed negligence on basic system security procedures and lack of data safeguards which makes the system easy to manipulate by fraudsters seeking to steal from the public purse.

Ifmis also runs on a poor network architecture, badly impacting its up-time and causing financial inconveniences.

On Tuesday, governors, who have accused National Treasury of generating erroneous documents that misrepresent their spending in the financial year 2017/18, lay the blame squarely on Ifmis.

The auditor general’s reports show that Kiambu, Kakamega, Kitui Nyeri and Kirinyaga spent hundreds of millions on functions over which they lack jurisdiction.

BUDGET REPORTS

But Council of Governors chairman Wycliffe Oparanya said no money was budgeted or spent on national government highlighted budget lines.

“It would be important to note that the figures in dispute as raised by the senate were never pointed out by the auditor general as point of queries to the individual counties during the audit,” Mr Oparanya said.

“County governments also prepare programme-based budgets approved by the county assemblies. Neither did they (assemblies), raise the anomalies nor did the issues raised in the management letter developed by the auditor general during the audit process,” he said.

Separately, Kirinyaga Governor Anne Waiguru said her county followed the laid-down procedures and generated correct reports from the Ifmis for the period in question.

"These official documents are available for inspection and were the basis for all county expenditure duly approved by the Controller of Budget," she said.

REVIEW

Laikipia Governor Ndiritu Muriithi said his administration had flagged errors generated by Ifmis last year and informed the system’s directorate, which confirmed that there was a configuration issue that resulted in the generation of erroneous reports.

Already, CoG, Treasury, the Auditor General and Controller of Budget have formed a joint team to probe county audit records.

The Senate has rejected a request by governors to suspend further appearances before it over audit issues until the technical committee formed concludes its findings within 14 days.

“We will demand a review for all the 47 counties. We are narrowing down on Ifmis that generates these reports, and we want to know who introduced these budget lines in the counties and why,” Mr Oparanya said.

Treasury has fought back, saying some counties were not following the correct procedures when recording expenditure on Ifmis, hence leading to the generation of wrong reports.

NYS SCANDALS

Principal Secretary Kamau Thugge said counties are required to prepare and submit budget estimates to their assemblies by both votes and programmes.

“The system generates reports based on the transactions captured by the users. In order for the financial statements in Ifmis to reflect the true position of the counties, you are required to capture all revenue and expenditure transactions,” Mr Thugge said.

Ifmis Director Stanley Kamangunya was unreachable for comment.

Since 2015, Ifmis has been used to perpetrate the two National Youth Service scandals that cost taxpayers Sh11 billion, the Sh5 billion Ministry of Health scandal and one that saw an unspecified amount of money diverted from the Kenya National Union of Nurses members’ deductions by counties and the Ministry of Health.