Is Kenya losing tourists to the rest of Africa?

What you need to know:

- Kenya's growth rate was also below the world's average which improved seven times as fast as Kenya's.

- A survey of prices in international grade hotels in selected major African cities revealed that Addis Ababa is the most expensive place for a good night’s sleep.

- By comparison, Johannesburg is a long-established, sophisticated international city, with a large number of five star hotels and a competitive market for accommodation.

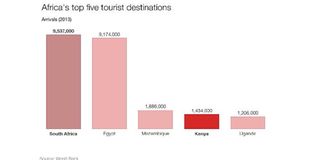

While Kenya is one of the top five tourists’ destinations in Africa and the prices of its international grade hotels are competitive, the performance of its tourism industry has lagged behind other countries on the continent in recent years.

Kenya receives the fifth highest number of tourists to Africa after South Africa, Egypt, Tunisia and Mozambique in that order.

A review of World Bank statistics between 2009-2013 show that tourists arrivals in Rwanda increased 24 times as fast as Kenya's, Ethiopia's grew 20 times, Tanzania's 18 times, Uganda's 16 times, South Africa 12 times and Mozambique's nine times as fast.

In the face of the recent terrorism incidents in Kenya, Nairobi's hoteliers have chosen to maintain rates but they have suffered with lower occupancy.

Kenya's growth rate was also below the world's average which improved seven times as fast as Kenya's.

According to World Bank data, in 2013, around 1.4 million tourists visited Kenya. Seven times as many tourists visited South Africa, a country with gross national income five times that of Kenya.

It was followed closely by Egypt, with six times the number of visitors to Kenya. Egypt’s gross national income is three times that of Kenya.

But it was not only richer African countries that beat Kenya in the number of tourism arrivals For instance, although Kenya's gross national income is twice as high as Mozambique's, tourist arrivals in that country were 25 per cent higher than Kenya's in 2013.

ETHIOPIA RISING

A survey of prices in international grade hotels in selected major African cities revealed that Addis Ababa is the most expensive place for a good night’s sleep. The average rate for a hotel room in the first six months of this year in Addis Ababa was Sh23,1780 a night, according to the survey by hospitality research firm STR Global.

This compares with Sh21,575 for a room in Lagos, Sh14,476 in Nairobi, Sh12,230 in Cape Town, Sh10,573 in Casablanca, Sh10,354 in Cairo, Sh7,290 in Johannesburg and Sh7,070 in Sharm El Sheikh.

Cape Town’s improvement is due predominantly to increased demand and no recent increases in supply since the 2010 World Cup.

With the price of a hotel room in Nairobi is almost double that in Johannesburg and the room rate in Addis is 60 per cent more expensive than Nairobi, one is tempted to ask how prices can be so different.

STR Global Director of Business Development, Thomas Emanuel says: “A great deal of the reason for the difference in rates across major African cities is simply supply and demand.”

Addis Ababa has a shortage of top quality hotels. But with the Ethiopian economy growing at a rapid rate of more than 10 per annum for the whole of the last decade, with more conferences coming to the city by virtue of its status as the seat of the African Union and with Ethiopian Airways on a similar growth trajectory to the country, thanks to new routes and increased passenger numbers, there is a high demand for premium hotel rooms.

By comparison, Johannesburg is a long-established, sophisticated international city, with a large number of five star hotels and a competitive market for accommodation.

Looking at how hotel prices have changed over the past year (year to date June ’14-’15), there have been substantial rate rises in Sharm El Sheikh, up 42.5 per cent , Addis Ababa, up 14.9 per cent , Johannesburg, up 11.0 per cent Cape Town, up 10.8 per cent and Cairo, up 10.6 per cent.

COLLAPSED OIL PRICE

Whereas, there has been a recovery in Lagos up 5.8 per cent whilst Nairobi is broadly the same and Casablanca has suffered a 4.0 per cent decline.

In the face of the recent terrorism incidents in Kenya, Nairobi's hoteliers have chosen to maintain rates but they have suffered with lower occupancy.

The increases in Sharm El Sheikh and Cairo can be explained as a recovery in tourism to Egypt, following several years of political unrest, according to STR Global. Cape Town’s improvement is due predominantly to increased demand and no recent increases in supply since the 2010 World Cup.

The rise in room rates in Lagos cannot be explained simply by supply and demand because there has been a combination of factors that would normally be expected to exert a downward pressure on price.

First, there is a hotel development boom in Lagos with 3,611 new hotel rooms in the pipeline, according to W Hospitality Group, second, there has been a collapse in the oil price, which is damaging Nigeria’s heavily oil-dependent economy and third, occupancy has fallen below 50 per cent.

The rate decline in Casablanca is due in part to economic weakness in France, its major source market and in part to currency fluctuations.